Berkshire Hathaway’s Warren Buffet and Charlie Munger have delivered investment returns of 20% per year over the past 55 years while the S&P 500 has returned an average of 10.9% annually.

Their phenomenal success is no accident.

To excel consistently in a discipline full of uncertainties requires work. But that is not all. Along the way, it requires us to build a toolkit based on our experiences and those of others. Then we need to get in the habit of using those tools in a systematic and disciplined way, over and over.

This is essentially their secret sauce. Sounds too simple. Doesn’t it?

Charlie Munger gets invited to deliver many commencement speeches. His words rarely capture the headlines, as he has said the same things many times. Only investors pay attention to him, as they try to gain insight from his wisdom.

He also alludes to the persistence of bad habits and our brains’ evolutionary quirks conspiring against making good choices.

I am awed by the simplicity and effectiveness of Warren and Charlie’s, methodology. “We do not invest in stocks of companies that are difficult to understand for us. Knowing your circle of competence is far more important than your IQ”, according to Buffet.

Too complex issues tend to overload the brain. Like overworked muscles, the brain fails to function effectively and goes wrong. Brainpower must be conserved for when we need it the most — just as basketball players conserve strength.

Charlie Munger is passionate about overcoming the hardwired human tendencies which make us slip. Munger credits this discovery to what Robert Cialdini of Arizona State University has written in Influence.

Munger has a much longer list of tendencies than Cialdini, and has a way to minimize their adverse impact on our decisions. He keeps a checklist for each tendency and then checks his stock-picks against each tendency’s undue influence on him. The process works for him.

How difficult can that be? But doing the same things over and over is boring. Munger claims he and Buffet make many business models of companies they are considering buying and see how they can make the models fail. “Doing this is a lot of fun”. Munger does not get picked as a “notable and quotable,” because his techniques seem like common sense.

This brings me to my favorite subject: the game of bridge. Charlie and Warren are bridge players. I am a fan of theirs, because they both love bridge and its challenges, the discipline the game demands, how tough it is to make the right choices while overcoming the quirks of the mind, which Munger mentions.

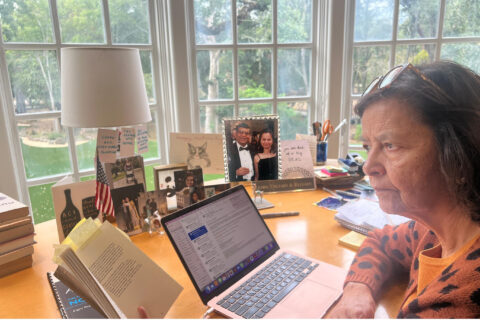

On Nov. 26, the day after Thanksgiving, I plan to compete in my first face-to-face one-week-long National Bridge Championships in two years. Nobody gives an inch, nor should I. But how?

In addition to the usual preparation for this tournament in Austin, I am reviewing the records of my last two years of online bridge tournaments. I have notebooks in which I recorded the hand-results, the questions, and the confusions. I also noted down my teachers; keywords and phrases — just in case I ever needed them. On one page I found scribbled, “control your impulses.”

Here is how my note-keeping compares with Charlie’s investment methodology. Our brain loves to gamble — a tendency on Charlie’s list. The brain asymmetrically processes gains vs. losses, he claims. It prefers gains! In bridge tournaments when things get intense, we tend to make wise plays, against the odds. We even convince ourselves that we had a good reason for what we are doing, such as opponents took too long to play a card, and that gave me a clue. However, opponents could have many reasons for taking longer — for example. Brain influences us to do wrong things because of our obsession with winning.

Like in investing, some mistakes in bridge can produce good results. And even when we do the right things, they may not work out well. Card combinations, like investment picks, are too numerous for us to process. We can avoid some mistakes, by not doing certain things, like getting tempted to be overly clever with our plays. Munger has delivered these messages many times. And those who do not process these conclusions properly, make mistakes and fail.

At a speech at Harvard in 1995, Munger said “the brain does not naturally know how to think the way Richard Zeckhauser [a National Bridge Champion and a professor of economics at Harvard] knows how to play bridge…it is a trained response” — to control our impulses.

However, bridge and investing differ in the velocity of decision-making. A bridge player has a few minutes to make a critical decision. While Buffet and Munger pick one or two stocks a year if that. And a basketball player makes split-second decisions.

We bridge players have to learn how Stephen Curry trains himself to maximize the chance of scoring a basket. It requires fitness training but also keeping focus, knowing which techniques to use when, keeping eyes on the ball, the footwork, the peripheral vision to where other players are. With mental and physical training and energy conservation, Curry gains the advantage over his rivals.

Winning in bridge requires Munger’s tools and Curry’s training.

Vijay K Gupta

People often think that a decision (made under probabilistic uncertainty) was a good decision if it led to the desirable outcome and a bad decision otherwise. In other words, they determine the goodness of a decision after its consequences are known. But according to decision theory, the goodness of a decision can, and must, be determined at the time of making a decision. It is independent of the final outcome.

Here is a hypothetical example. Suppose, in a game of bridge, you have the choice of playing the queen of heart or ace of heart. Based on all the available information (from bidding, etc.) there is a 33% chance that playing queen is better and a 67% chance that playing ace is better. However, you impulsively play the queen. And as luck would have it, the queen turns out to be the better choice. Your partner congratulates you later on a great play. However, the fact remains that from a decision theoretical point of view, you played poorly because you should not have relied on luck.

Similarly, people don’t outperform the market in the long run by being lucky. They outperform it by being very methodical–by optimizing the ‘expected value’ of ROI. Nonetheless, human nature being what it is, it is very difficult for us to be self-critical about a particular decision which led to a good outcome, or to feel good about a (theoretically) good decision which led to a bad outcome.

vinitagupta

very well put, Vijay

Ravi Prasad

Risk vs. Return !!

How many fund managers have been able to consistently outperform the S&P 500 ??

Hemant Lall

A great observation: bridge, investment and life all require one common trait … discipline!

See you in Austin.

Hemant

Ashok Ahuja

Good article, Vinita. Thanks. Best with the tournament. Stay safe.

Holden Caulfield

So pleased to see Richard Zeckhauser mentioned. I’m not a serious bridge player, although I understand he’s one of the finest players of all time. He’s also a famous Harvard economist, having brilliantly discovered that positive online reviews influence shopping decisions. I’m just in awe of genius like this! I’m endlessly fascinated by the inner-workings of the greatest minds of all time. Thank you for sharing the wisdom you’ve accrued on your highly successful and impressive bridge journey. And thanks for explaining how Buffett and Munger have so successfully beaten the odds for decades on end. A cynic might imagine these powerful men had some kind of insider knowledge. Now I know how they really did it.

Gaurav Agarwal

All the best for your Bridge Tournament, Bua. Take care.

Dev Shukla

Vinita,

Fantastic article and wise observations. It requires so much discipline to avoid or even justify the wrong tendencies in search of Euphoria.