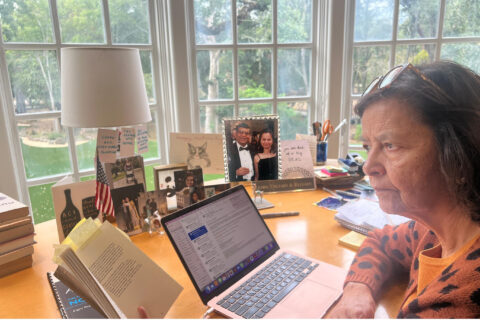

Last Monday I got up at 5 a.m. to get a seat in the courtroom where Elizabeth Holmes, the founder and CEO of Theranos was on the stand in her own defense. Reporters and curious Siliconeers had come in droves to see history in the making.

Seeing all of the TV cameras made me feel good about my own decision to come. Then I saw the camera crew rush off, and when I followed the crowd, I caught a glimpse of Elizabeth Holmes, flanked by her partner Evans and her mother Noel.

Although Holmes is facing serious criminal charges, she will remain a tech icon.

Presentation of evidence in the trial is continuing. Based on my conversations with people who were waiting in line, it was obvious that the opinions on Holmes were divided — a retired NASA scientist spoke of Holmes with admiration, while his wife rolled her eyes.

People were there partly to see and hear her but also some to confirm their own views of Silicon Valley’s underbelly.

Holmes and Theranos’ Chief Operating Officer Sunny Balwani claimed that Theranos developed a revolutionary and proprietary analyzer to perform a full range of clinical tests using small blood samples drawn from a finger stick. This analyzer could produce faster, more accurate, and reliable results than conventional methods could.

According to the podcast The Dropout, investor Brian Grossman, Founding Partner of PFM fund, offered strong credible testimony to the contrary. Investing in startups is tricky. Unlike most other investors of Theranos, Gossman is a professional Valley VC who did his homework.

Theranos raised $1.3 billion, but most money came from non-traditional investors like Rupert Murdoch, Walgreens, and Larry Ellison who were swept by the hype of a hot start-up.

Our friend and Valley investor Tim Draper who provided the initial funding for the company is an outspoken defender of Theranos. But he did not take the stand.

Other witnesses eluded that Theranos often used standard commercial equipment to generate data and pretended that it came from their platform, but no hard proof was offered.

This is a historic trial for several reasons:

- Unlike Enron which was financial fraud, Theranos is the first major Silicon Valley company being sued for misleading investors. Class-action lawsuits for product delays by corporate ambulance chasers are commonplace and are usually settled outside of court.My company Digital Link had to pay millions of dollars when we failed to introduce a leading internet product on time. Revenue expectations for future quarters were not met, even though we fully disclosed the risks in the SEC filings. This is the cost of doing business. Billions of dollars have been invested in startups, but Silicon Valley venture capitalists do not file lawsuits against the founders because they do not want to get a bad reputation and then be excluded from the next hot deal.

- Theranos is the first unicorn led by a woman entrepreneur who was also a college dropout, like Steve Jobs, Bill Gates, and Mark Zukerberg.

The government is suing Elizabeth and Balwani for defrauding potential investors by making misrepresentations about their future prospects; and for defrauding doctors and patients by making false claims about their ability to provide accurate, fast, reliable, and inexpensive blood test results.

I borrowed Bad Blood, John Carreyrou’s book about Theranos and Holmes, from a friend who was the CEO of Palo Alto Medical Foundation — when it first came out in 2018. He believed that Elizabeth Holmes was deliberately concealing information from investors and hyping the company’s product capabilities.

He was shocked to hear from me about how hi-techs work. With my extensive experience in managing research and development in Silicon Valley, I tried to explain that developing a technology product is unpredictable, as the technology has not yet been invented. Predicting, product delivery schedules is a two-sided coin. If you pad the expected completion date to ensure on-time delivery, you may be accurate but miss the market window. As a result, CEOs negotiate with engineering for expediency and are often late in delivery. The CEOs then try to pacify their customers and investors, while continuing to pressure the organization to deliver. Being comfortable is not part of the startup culture — we live on the edge.

How does Silicon Valley balance optimism and wishful thinking with realism?

I might argue Theranos was just late in perfecting the technology — which is not too unusual. They claim that investors and customers did not fully grasp what they disclosed.

Holmes at 37, came across as a mature voice to me when she testified.

But, so far it has been easy for Ms. Holmes. She is being questioned by her own attorney, and she has rehearsed her answers. The real test will come when the prosecution places her under cross-examination.

The safest way to respond to the prosecutor will be to answer “yes,” “no,” or “I do not recall.”

Holmes can be personable, according to the journalist Roger Parloff of WSJ, who initially interviewed Holmes, in 2015 and wrote an article.

So was Theranos just late in delivering the new technology, or was that technology nonexistent?

If Holmes committed a crime, she should not go unpunished. The jury will have a great deal to think about.

…to be continued

Dominique Trempont

Very interesting and original angle in looking at this case, Vinita. Well done.

Vijay K Gupta

Theranos promised a real breakthrough in blood testing technology–doing multiple blood tests using a single machine and with a dramatically (orders of magnitude) smaller amount of blood. This is analogous to doing multiple body scans with a single multi-purpose machine using a dramatically smaller amount of radiation.

What is not clear to me from media reports is how far along the company was in its R&D. Did they demonstrate a solid proof-of-concept (POC) in the lab but failed to make a commercially viable product? Or did they fail to demonstrate the POC itself? Or did they deceive the investors by faking the POC?

My point is that if the POC was solid, then some other company (with more experience in making similar products) should be able to productize the idea. OTOH, if some people invested in Theranos without witnessing a real POC, then they took too much risk and probably deserve to lose their money. Finally, if the POC itself was fake, then the Theranos founders ought to pay for their crime.

Aarti Awasthi

Vinita, I am impressed you went to see the drama in place. Theranos/ Holmes has an impressive story. The book lists the details into concealing and misrepresentation which is different from being late while on track for the new technology. There was blatant malpractice and mis representation and threats… If the technology was real it would have surfaced by now in some shape or form. THERE IS ZERO-(

Peg Kaplan

Viinta, you continue to impress me so very deeply in a variety of ways! You are able to ferret out so much through straightforward examination, give significant information to others without putting on a "show". And your reasoning is always both thoughtful and full of your years of study, honesty and depth. I hope you continue to share the path of Theranos; you are a never ending person with mega top qualities and intelligence!

Prakash Paranjape

Since this is going to be continued, would you care to compare these allegations with the allegations of cheating in Bridge? And how about comparing her promises to those of the central bankers? They promised that they will control inflation and miserably failed, yet nobody is even pointing a finger at them. Quite likely, billions have been lost because of that failure, yet, they are not being brought to book. Isn’t that odd?