We make all kinds of small and large decisions every day. Decision-making is a learned skill that can be improved with deliberate observations, personalized processes, and then training ourselves to use them effectively.

The book, The Art of Critical Decision Making by Michael Roberto, reveals how bad choices are usually the result of poor decision-making.

For me, it still is a struggle.

Serving on several boards, it is often hard for me to recall what was discussed in the last meeting and what my thoughts were at the time. I usually prepare prior to the board meetings, and scribble notes during the session. But then I realized, if I do not capture the essence, much gets lost. I now spend 30 minutes after each meeting summarizing what I had heard, and if I still had any questions left. This is an example of making the decision to contribute more effectively as a board member.

The other example which requires decision-making on steroids is the game of bridge. I have been playing competitive bridge for 15 years now. Bridge tests all the flaws of the mind, like biases, forgetfulness, and preoccupation of the mind. When I am in a bridge tournament, the quantity of decisions quickly tires the brain and it is not easy to know why I made even obvious mistakes. I need to sort my mistakes into different buckets, devise different processes for each bucket and practice them over and over until they stick.

Simple decisions require us to make judgments based on instincts. Our instincts are based on our prior experiences. For more complex ones, like whether or not to accept a job offer, when to change jobs, or when to retire, we try to predict how those decisions will impact our future.

When we find that we have made a poor decision, we often overanalyze what we did wrong, instead of looking for a pattern across our mistakes and learning to correct the pattern, which is far more useful — but not easy.

A new and useful body of social science literature explores how to make better decisions. The social science research is complemented by the work of neuroscientists who study the brain and look for ways to correct the flaws in cognitive function.

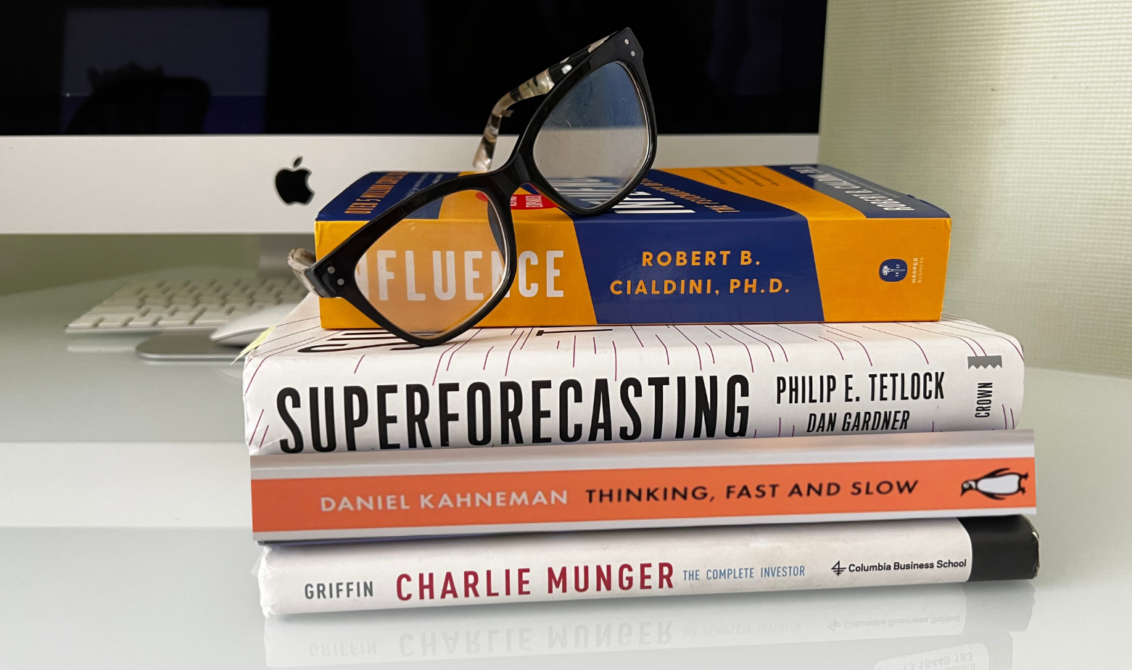

Daniel Kahneman, the Nobel Prize-winning author of Thinking, Fast and Slow, and psychologist Amos Tversky identified more than 180 cognitive biases that interfere with how we process data, think critically, and perceive reality. When bias clouds our minds, we cannot make accurate judgments. Kahneman does not offer many remedies; he admits that even he cannot overcome his own biases.

In his book Influence, Robert Cialdini, professor emeritus of psychology at Arizona State University, discusses the irrational tendencies that can influence us to go wrong. For example, the tendency to win is much stronger making us prone to irrational low-probability bets like buying lottery tickets. Understanding some of these tendencies is the first step to curtailing them.

The billionaire investor Charlie Munger is an admirer of Cialdini’s work. Munger sent Cialdini some Berkshire Class A stocks certificates with a note saying, “Warren [Buffet] and I have read your books, we’ve made hundreds of millions of dollars. This is our way of saying thanks.”

The book Super Forecasting: The Art and Science of Prediction, by Phil Tetlock, professor of psychology and political science at the University of Pennsylvania, and journalist Dan Gardner offers practical and valuable insights into decision-making.

In 2011, the government recruited Tetlock and several thousand ordinary people to forecast the likelihood of several global events, such as, if the price of crude oil would exceed $40.30 per barrel in the next 60 days.

There were several rounds of questioning; each round consisted of more than 100 questions. After each round, the top 40 “superforecasters” were identified and included in the next round, and more amateur forecasters were brought in. This experiment went on for four years. The forecasters were asked to enter their initial ‘probability number’ of the event happening in the given time frame, and to keep updating it up or down as many times as they chose; until that round was over. Then the forecasters were required to give their final answer “yes” or “no”.

The results were astounding. The amateur superforecasters consistently predicted better than the experts in the field by a big margin.

Tetlock concluded that superforecasters:

- were not merely lucky but more systematic in making their predictions. They updated their probability number more frequently, based on new generally available information.

- examined their answers from multiple angles, and gathered perspectives from different types of sources, reducing “excessive reliance on [their own] intuitions” — a bias — per Kahneman.

Tetlock also concluded that a systematic approach was part of superforecasters’ repertoire.

These findings are both useful and encouraging as they can be cultivated by most.

My successes in life have been about making a few good decisions and learning from many bad ones. My goal is to become a better decision-maker, not necessarily the best; that’s too vague. Getting better can be measured and felt, and therefore improved. Getting better year after year has a cumulative effect, called ‘compounding’ by investor Charlie Munger. And success is only the byproduct of better decisions.

Valerie

Fascinating Vinita. I would love to know how you keep track of bridge mistakes then organize into buckets to study later.

Sreedhar Menon

VERY FACTUAL AND EXTREMELY USEFUL IN EVERYDAY LIFE.

Vijay Gupta

Most systematic decisions are supposed to be made based on available and quantifiable data. However, in most cases, available data is neither enough, nor fully reliable. Therefore, people also rely on intangibles like intuition and trust. These considerations in decision-making often look like biases to others, but they have an important role to play in real-life decisions.

For example, most people chose to get the Covid vaccine based on the official data regarding its risks and benefits. However, I did not really trust the sources of that data, namely, the vaccine companies. Therefore, I decided to wait. But could I quantify the trust factor, for example, to convince others? Probably not. They thought I was biased. Sure. And I am happy to remain just as biased even today.

Judy

Vinita, I’m glad you’ve chosen to write about this as it is something I am quite interested in. I have read a lot about "recency bias" – the tendency to react to your most recent failure rather than looking at the next situation dispassionately. For example if you double your opponent in bridge and they make the contract you may be less likely to double the next time. The problem is separately recency bias from simply learning from your mistakes. If you figure that out let me know 🙂

vinitagupta

Good point, Judy. I relate well to bridge.

Vijay Gupta

Judy, recency bias or ‘recency factor,’ if you will, is a fundamental and ineluctable characteristic of human decision-making. The survival of our hunter-gatherer ancestors depended on prioritizing recent information in their decision-making. But even today, there are plenty of examples of the recency factor at play. In an annual review, a manager gives more weightage to employee performance during the recent four months than during the previous eight months. An ‘October Surprise’ has more influence on the Presidential election than an ‘April Surprise.’

In competitive games, one must also consider the fact that your opponents’ goals and strategies may change over time. Thus a bridge team that has just made a contract after your double may indeed be bidding more conservatively at that time than they typically do. And so perhaps you should also be a bit more conservative about doubling again. In general, however, the recency factor affects our decisions subconsciously. We can minimize its impact on our decisions by simply becoming conscious of it.

Deepka lalwani

Intuition has a big role to play in decision making, we may not understand how n why. Not everything is understood by 5 senses.

I liked Sundar Pichai’s response on 60 min interview

“Let me put it this way. I don’t think we fully understand how a human mind works either.”

Fred Stewart

Excellent reading. Great content. Thank you

Prakash

Well, HP had used something similar to get a very good estimate of printer sales. They had an extra element of people placing small bets with their estimates if I remember right.

Hemant Lall

Thank you, Vinita. May this article reduce randomness in choosing our better half, and more everlasting relationships!