On October 10, this year’s Nobel Prize of Economics Sciences was awarded to Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig. Understanding the impact of their work is especially important in the current economic environment when “inflation is high, interest rates have been rising and bond and stock prices have plummeted. Predictions of a possible recession are proliferating.” And what role has the U.S. government played and how will it ensure the soundness and integrity of our financial system?

To curb high inflation, the Federal Reserve, the United States central bank, announced several large interest rate hikes this year. According to the WSJ, economists are worried. “The Federal Reserve’s big interest rate increases are raising the risks that it will overshoot.” How does the Fed balance the near-term and long-term impact of its actions?

Because no economic institution can strike this balance, perhaps this is why it took the Nobel Committee 40 years to see if the Laureates’ research actually worked and truly helped humanity in a significant way.

Ben Bernanke was the chair of the Federal Reserve (2006-2014). In a 2002 speech, he said that “most monetary policies are derived based on historic data, and ‘natural experiments.’ And natural experiments, by definition, cannot be done in a controlled environment.” This implies that they cannot be 100% conclusive, and correlation does not always mean causation. Long-term implications of any move today are not only difficult to predict but also their effects are difficult to measure, because the environment changes, so different knobs need to be turned.

Bernanke understood how bank runs prolong economic crises — a self-fulfilling prophecy. He emphasized the government should try to save important banks; otherwise, the panic causes other banks to fail.

Bernanke’s tenure as the head of the Federal Reserve coincided with the economic crisis of 2008-2009. The Nobel Committee praised him for supporting the bailout of the banking, automobile, and insurance industries, thus preventing an even worse crisis. It was not a popular decision at the time.

The Federal Reserve’s statutory mandate is to promote maximum employment, stable prices, and moderate long-term interest rates. They look at their crystal ball and tweak short-term interest rates, the money supply, and/or the percentage of reserves that banks are required to hold (and not lend) against the deposits.

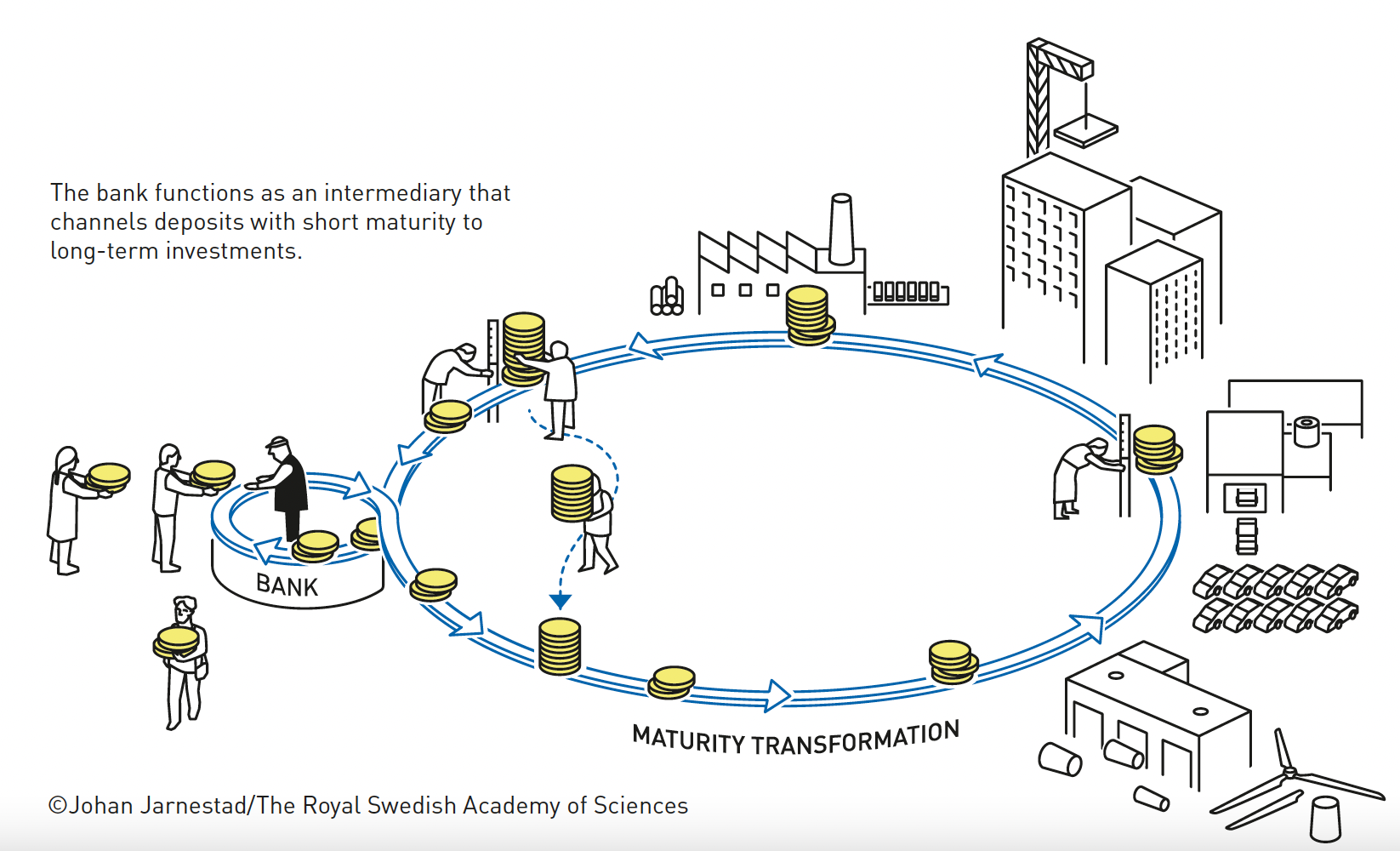

According to the Nobel Committee’s press release, the other two laureates in the Economic Sciences, Douglas Diamond and Philip Dybvig, explain in a 1983 paper how banks, besides providing liquidity between borrowers and depositors, monitor borrowers’ ability to pay back. It is valuable data for future lending decisions which a bank can use in the future but is lost forever when a bank fails. “The bank makes an initial credit evaluation and then also follows how the investment is progressing. Thanks to this, many bankruptcies can be avoided and societal costs are reduced.”

Alfred Nobel’s will states that prizes be given, “to those who…have conferred the greatest benefit to humankind.” Their theory and new understandings alone were not sufficient to qualify them for the awards until the committee saw how it benefited society at large. For the same reason, Einstein was never awarded the Nobel Prize for his theory of relativity — the difficulty in judging its “greatest benefit for humankind” then.

The Fed balances the regulation of banks for the safety and soundness of our financial system while allowing capitalism to flourish.

In the crypto world, without regulations, and without banks, we would lose the benefit of money that flows from depositors to borrowers, for producing more goods and services for GDP growth.

In addition, the executive branch and Congress set fiscal policy; taxation, budgets, making investments in economic development, trade balances, and safeguarding to counter unexpected disasters.

Post-COVID, Congress passed a stimulus package of almost $2 trillion to prevent an economic downturn, encouraging consumer spending but it also drove prices higher.

Another $2T in bills to improve infrastructure, and make investments in chips, climate change, and healthcare were passed. What spendings are investments in the future vs handouts for political gains?

If COVID-related workforce shortage caused increased wages resulting in higher prices, these inflationary factors may be short-lived. But also if hourly workers’ wages have gone up, that is not an undesirable outcome — wage disparities have been increasing for decades. And if inflation is due to limits on imports of cheaper foreign goods, that may also be good for reducing the US deficit, although it is government interference in the capital markets.

In this complex web, we cannot always predict where the roulette wheel of the economy will stop, sending us into another depression. But with the tools the Nobel Laureates have given us; the importance of saving banks to preserve borrowers’ relationship database, with banks, we will get better at spinning the wheel of real money.

6 responses

It's all very good to bail out banks (in a time of crisis). It is the structure of the bailout that is worth criticism. The institution saving the bank should do so in a way that the party providing the funds partakes in the commercial upside (if one eventuates). For example, by taking an equity stake or issuing a convertible. The shareholders of the banks should not get a free ride when the bank encounters crisis. This is the norm in all other equity market enterprises. While a failing airline, say, may not necessitate regulatory intervention, a failing bank ought to be 'saved' but using a fairer framework than was used.

Thanks for your more precise clarification of the issues.

Vinita reminds us: "Bernanke’s tenure as the head of the Federal Reserve coincided with the economic crisis of 2008-2009. The Nobel Committee praised him for supporting the bailout of the banking, automobile, and insurance industries, thus preventing an even worse crisis. It was not a popular decision at the time." But looking back, it was the right decision.

I have faith in the great economists of this great country. They have brought down unemployment to the lowest level in decades and wages have increased especially for the needy. They will soon tame inflation and will be looked back as economic heroes of our times. — maybe even worthy of a Nobel prize!

Hemant

VERY USEFUL INFORMATION IN TODAYS MARKET ENVIRONMENT!

Vinita – this is a complex subject and I commend you for taking it on. Many of us struggle to understand the forces that drive inflation and interest rates, and the balancing act being performed by the Fed and peer institutions to restrain inflation without causing a recession.

The FED's mandate is to control the inflation to near 2% and to maximise employment. Let us examine whether they have made any real attempt to control inflation. In nature, we have cycles of varying duration. Room heating is one example. A cold room takes some time to heat up. Nobody installs industrial scale boilers at home just so that the house heats up the very minute you enter the house. The periods, frequencies, and amplitudes of many such systems have been studied for many decades now. Excellent control systems are now available.

In a refinery, for one example, crude may arrive from different places, product mix may change on a weekly basis, and price fluctuations are ubiquitous. Modern control systems handle these jobs rather well even when the understanding of the underlying processes is not all that great. I have myself implemented one such control system when it was a pioneering work.

Based on my experience, I firmly feel that the economists have failed in controlling inflation. In fact, as far as I can see, they haven't even tried.

How does society treat failures? Let me quote an example from Italy. About a decade back, there was a big earthquake in Italy. It flattened a few villages. There were many deaths. Top class scientists who were tasked with predicting earthquakes were taken to task. Many of them faced harrowing times. Some were imprisoned for some time at least.

How should the central bankers have been treated? I will leave the answer to you.